preserving exact and thorough information is essential for maximizing your tax deduction for charitable donations. This includes:

you will discover sure hoops You could have to jump by before you can assert a charitable donation tax deduction. For instance, for gifts of $250 or maybe more, you need to get a composed acknowledgment from the charity stating the following:

you should Notice: the knowledge supplied Here's not intended to be relied on in lieu of tax or lawful guidance. check with using a tax advisor or legal professional for information and facts connected with your particular scenario.

Tax guidance, qualified critique and TurboTax Live: entry to tax advice and specialist overview (the ability to Use a Tax skilled critique and/or signal your tax return) is bundled with TurboTax Dwell Assisted or being an enhance from An additional version, and available through December 31, 2024. Intuit will assign you a tax expert according to availability. Tax expert and CPA availability can be restricted. Some tax subject areas or cases is probably not provided as section of this service, which shall be decided in the tax pro’s sole discretion. for that TurboTax Live Assisted merchandise, if your return necessitates a significant degree of tax suggestions or genuine preparation, the tax qualified may be necessary to indicator as being the preparer at which stage they can presume Key obligation with the preparation of the return.

The acknowledgment should say whether the Corporation gave you everything in Trade for your present and, if so, should give a description and a very good faith estimate of the worth of These merchandise or expert services. You’ll only be capable of deduct the quantity that’s over the worth from the benefits you received in the charity.6 For smaller sized quantities, bank statements and receipts in the corporations you donated to can serve as proof. How Do I assert Charitable Donations on My Tax Return?

not surprisingly, no person donates to charity only for the tax benefit. But any tax savings can persuade a lot more providing—and carrying out nicely though undertaking superior retains an abundance of appeal. Listed here are 3 tax-good approaches to donate.

watch all tax preparing and filingTax credits and deductionsTax formsTax software and productsTax preparing basicsNerdWallet tax submitting

enroll and we’ll send out you Nerdy articles or blog posts regarding the money subject areas that issue most for you along with other strategies to assist you get far more out of your money.

Kyle Wetters co-founded Tenet Wealth companions in 2021, intent on putting his client’s passions over all else. to be a Qualified fiscal PLANNER™ practitioner, with more than 17 many years of expertise inside the monetary market, he makes a speciality of retirement arranging for his customers. Kyle listens to his consumers’ ambitions and values to develop extensive-term strategic strategies to […]

Some men and women opt to make charitable donations by means of their retirement accounts. This tactic, often called a qualified charitable distribution (QCD), enables individuals who are no less than 70 ½ yrs outdated to transfer around $one hundred,000 per annum straight from their IRA to a professional charity. the quantity transferred is excluded from taxable income, delivering likely Trends tax savings.

This should incorporate the date, amount of money, and an outline from the donation. For donations made by Test or bank card, a financial institution statement or credit card statement demonstrating the transaction can serve as evidence of donation.

by way of example, you almost certainly are unable to deduct a donation given via a GoFundMe site to help you an area small business that's struggling or a neighbor whose home burned down.

pupil financial loans guidePaying for collegeFAFSA and federal student aidPaying for vocation trainingPaying for graduate schoolBest personal student loansRepaying university student debtRefinancing university student debt

Donating your automobile to charity may end up in substantial tax savings should you include things like it in the charitable contribution deduction. The inner profits support (IRS) involves you to work out your tax deduction in one of two approaches, determined by how the charity employs your donation:

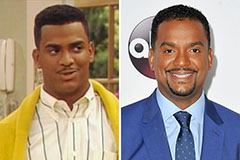

Alfonso Ribeiro Then & Now!

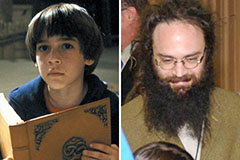

Alfonso Ribeiro Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!